Torch Development Area

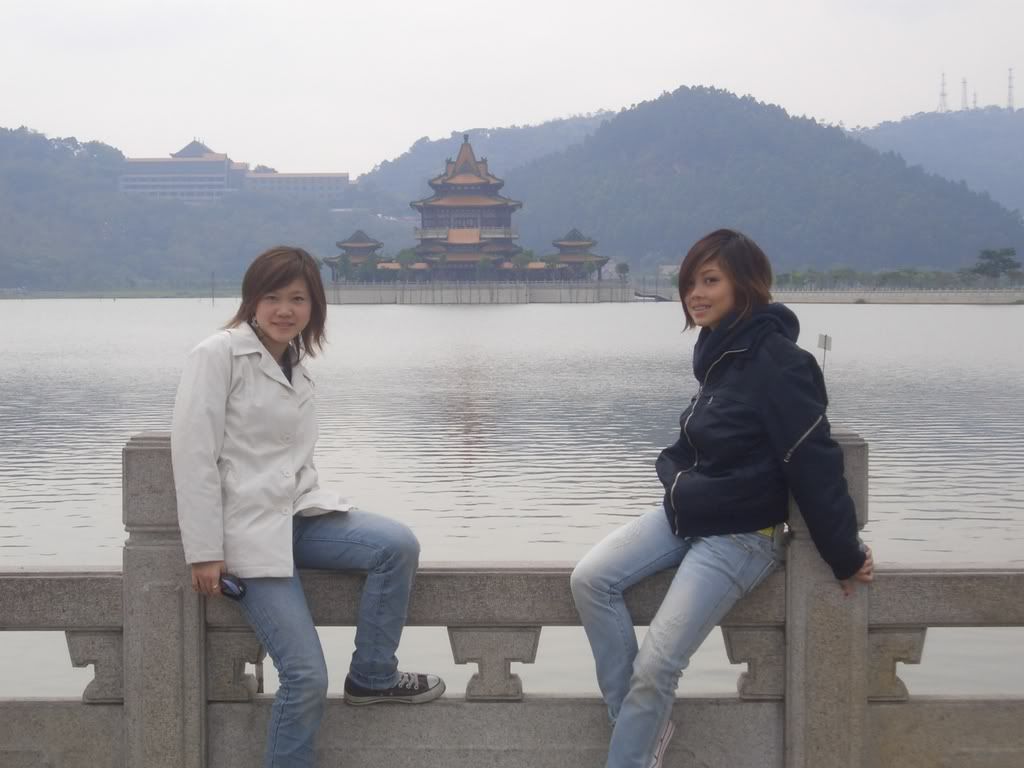

Zhongshan known for the hometown of the giant Dr. Sun Yat-Sen, city develops its society and economy in perfect harmony, and in recent years, Zhongshan city won a series of honors included “National Hygiene City”, “ National Gardening City”, “ United Nation Human Settlements City”, “Demonstration City of National Environment Protection”, “China excellent tourism city”, “National Two _ Support Model City” and “National Technology Model City”.

The zone is located in the east of the Zhongshan city, 12 kilometers away from city centre. Facing the estuary of the Pearl River Delta on the east, it is adjacent to Shenzhen and Hong Kong, only separated from them by the sea. It is also approximated to Zhuhai and Macao on the south, Panyu district of Guangdong and Shunde on the north, Jiangmen and Foshan on the west. Of which we have been to Zhuhai, Foshan, Gaungdong, Shenzhen and Hongkong=). This favorable geographic location is a strong guarantee for the zone to make a rapid advancement.

Transportation:

The zone is situated in the centre of the Pearl River Delta with favorable transportation networks. By land, Jingzhu highway, Guangzhu East Highway are interlaced with Yixian Road, Humanmao road, Zhongshan harbor road running across the city; by water it only takes 70 minutes to reach Hong Kong by hydrofoil from Zhongshan port, which as one of the top ten container ports in China, it can handle over 700,000 containers with 4 million tones cargoes per year; by air, it is very convinent accessing to the sex airports nearby. The railway across the Pearl River Delta and the guangzhu railway are schedule to set stations in the zone.

Water Supply and Power Supply:

With four 110KV transformer substations and 2 waterworks supplying 10,000 tons of water per day, the zone can provide sufficient water supply and power supply.

Complete Facilities:

The zone offers a comprehensive set of facilities of telecommunications, hospital, school, hotels, shopping centers and entertainment places. Combining various functional districts and industrial parks, a hi-tech industrial city has formed integrating research and development, production, logistic and living.

In order to make use of the influence of central cities of Guangzhou, Hong Kong and Macao SARS, Zhongshan has planned a strategy for its Eastern Economic Development Area, so as to accelerate the construction of infrastructures and urbanization of the eastern coastal area based on the zone as a leader, and to achieve group development. It is foreseeable that the software and hardware investment environment will be further improved.

High efficient Service

The development zone constitutes administrative organizations based on high standards of state level, dedicating itself to provide domestic and international businessman effective, efficient, professional and international high-standard services. Moreover, the zone focuses on human services through providing one-stop services form negotiation to registration, from factory construction to manufacturing and to export. There are also special bonded warehouses in the Zone in order to facilitate the import and export of raw materials and products (this as observed during the trip and post trip presentation is one of the main advantage the business people loves =). You know what I mean and the reason behind - tax saving solution)

As a state-level development zone, Zhongshan Torch Development Zone enjoys not only the national beneficial policies, but also Municipal Economic Management Rights as a prefecture-level granted by Zhongshan municipal government, and also, the city government set up first grade financial system and favorable supporting policies in the zone, Such Municipal departments as industrial and commercial administration office, taxation, Country land, planning and public security, electricity supply and labor have all set up substation branches in the zone. In particularly, the investment and management service center in the zone, which integrated 20 functional offices, provides a service platform and guarantees one-stop service in high efficiency for investors.

For accommodating to the new circumstances, the zone has emphasized on providing comprehensive service for high level enterprises from home and aboard combining such advantages as industrial facilities, completed market and systems normative.

The zone has many manifesting advantages for domestic investment and also foreign investment.

For domestic investment, certified hi-tech enterprise, income tax rate will be levied at 15%. 5% of paid income tax will be refunded authorized by Municipal Financial Department to the enterprise whose export value exceeds 70%. New high-tech business shall enjoy income tax exemptions for 2 years starting from the year in production. For enterprise in business difficulties, at the expiry of such period, the paid income tax can be refunded authorized by Municipal Financial Departments within 2 years. For domestic hi-tech enterprise who are established at state-level or provincial-level, 25% of local levied collected income tax will be refunded from the date of first selling within 2 years for the provincial level and 3 years for the state level. For the enterprise who meet the request of state-industrial policies on the technical rebuild projects invested in China 40% if the domestic investment for the technical rebuild projects which are in compliance with contents of current emphasized and encouraged state industries and products and technology.

For Foreign investment, income tax of foreign-invested enterprises who intended period its 10 years or up can enjoy exemption for 2 years and reduction for 3 years from the year they make profits. Exemptions and reduction of income tax shall be applied to a certain period according to the tax. After that period, for the authorized advanced technical standards enterprises, 50% of the income tax will be levied on the tax law within the extended 3 years; meanwhile, the local income tax will be exempted. For the export value according to the tax law (the minimum rate should not be less than 10%) Should re-investment in developing hi-tech enterprise or product, which has more than 5 years, intended period is made after profit, the paid income tax for the re-invested portion shall be refunded. For the foreign party of the non-hi-tech enterprises, 40% of the paid income tax for the re-invested portion whose intended period is not less than 5 years. Etc.

As from the above examples we can see that the zone is helping the new business startups as far as it can. There are also other favorable treatments provided for.

To contact them:

Telephone: (86) 760-533933 (main) 5597902

Website: www.zstorch.gov.cn

Email: info@zstorch.gov.cn

Address: Kangle Dadao, Torch Development Zone. Zhong Shan City, Guandong province, P.R China